Natixis

Together, Solomon Partners and Natixis provide comprehensive investment banking solutions for clients

Our Natixis Partnership

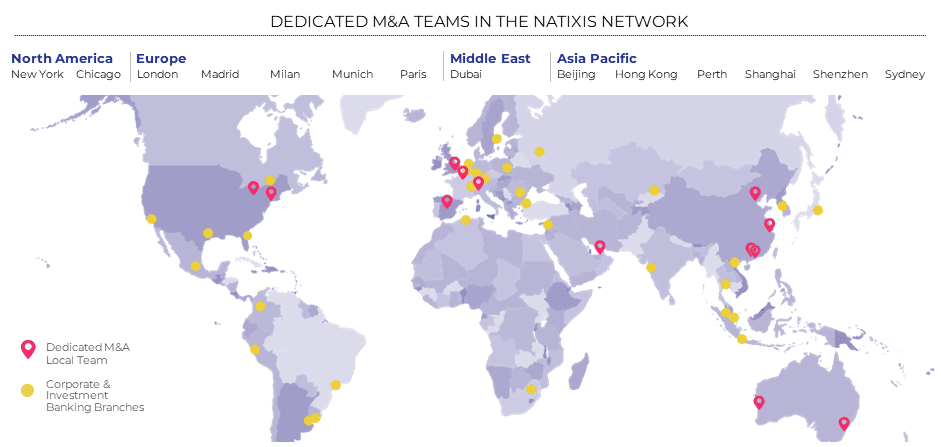

Our partnership with Natixis, the international corporate and investment banking, asset management, insurance and financial services arm of Groupe BPCE, provides our clients global advisory services and proprietary access to financing capabilities throughout Europe, Asia Pacific and the Americas. Our partnership began in June 2016 when Natixis acquired a 51% stake in Solomon Partners to expand its global investment banking platform.

Natixis holds a strong track record of assisting clients in raising capital for acquisitions, leveraged buyouts, restructurings and recapitalizations and has significant cross-border transaction experience complemented by multi-currency funding capabilities. Natixis also offers structured products to assist clients in financing and risk management for equity positions, including hedging strategies, margin loans and equity swaps.

In Conversation

With the four-year anniversary of our partnership approaching, Marc Cooper speaks with Marc Vincent, Global Head of Corporate & Investment Banking at Natixis about our partnership.

OUR CLIENTS HAVE GLOBAL ACCESS TO

- Global platform with >21,000 employees across business lines and geographies, including 2,600 in the Americas.

- More than 350 M&A Professionals with Corporate & Investment Banking offices throughout Europe, Asia Pacific and the Americas.

- Capital Markets expertise with strong track record to assist clients in raising capital for acquisitions, leveraged buyouts, restructurings and recapitalizations.

- Significant cross-border transaction experience complemented by multi-currency funding capabilities.

- Structured Products to assist clients in financing and risk management for equity positions, including hedging strategies, margin loans and equity swaps.